Having “Negative Equity” on your car loan means having more left to pay on the loan than the car would be worth to sell. It’s also called “being upside down” or “being underwater,” and for good reason.

You’re stuck in a car you can no longer afford, or no longer need. In order to sell it, the loan amount must be paid off in full, but in order to pay it off, you need to come up with a little – or a lot – of extra cash. In order to escape, you may be advised to take on even more predatory loans, or worse – to trade your existing debt into a new car, pushing you even deeper underwater. As time passes, you’re far from making progress – that new car keeps depreciating, no matter how many payments you make on it.

It’s likely that you or someone you know has been trapped in an upside down car loan. It’s a situation that’s becoming frustratingly common for North Carolina drivers.

Debt.org reports that in the first quarter of 2017, 33% of new car sales were to individuals who still owed on existing cars, and 26% of trade-ins involved negative equity – a record high.

Unfortunately, there is no quick solution to reversing negative equity. Every situation will require a unique plan of attack.

We’ve compiled 5 different strategies to help you identify the best way to get out of an underwater loan.

How Far Underwater Is Your Loan?

First, how do you tell how far underwater you really are?

Get your car’s FMV (Fair Market Value) from Kelley Blue Book or Edmunds. Their online valuation tools can help produce a range to expect for the value of your car.

Kelley Blue Book: What’s My Car Worth?

You can also check local listings to find prices for cars like yours. Make sure to be as specific as possible when comparing other cars against yours. Mileage, wear-and-tear, and non-standard options can all significantly impact the price of the vehicle.

Once you have your range, subtract the highest and lowest amounts of the range from your loan.

For example:

Remaining Loan amount: $10,180

FMV: $8,500 – $10,000

This would put our example car between $180 and $1,680 underwater. On average, car owners with negative equity owed $5,000 or more on their existing loans. (Debt.org, 2017)

How To Fix Negative Equity

There are many ways to resolve negative equity, but the best option for you often depends on just how much of it you have to contend with.

The more negative equity you have, the more difficult it will be to resolve. No one perfect solution exists, so it’s important to carefully weigh all the options before taking action.

Be wary of any quick fix options. It’s important to deal with people and companies you can trust. If their promises seem too good to be true, they probably are.

#1: Debt Consolidation

Works best when:

- Your total debts (including negative equity) aren’t excessive.

- You have a plan to reliably pay down the debt.

Pros:

- You’ll be able to sell your car quickly.

Cons:

- You’ll be left with the outstanding debt.

Debt Consolidation will help you pay off your entire auto loan, so you can sell it without the added complication of negative equity.

It’s important to understand that consolidation doesn’t remove negative equity, just shuffles the debt around – but at the very least, you’ll be able to sell your car. This can help you switch cars if you need to, like during a change of life or for a business expense.

Just be careful. Debt consolidation companies often prey on people in unstable situations in order to trap them in extended loans that, even with lower interest and lower monthly payments, could end up costing you in the long run.

Debt consolidation works best if you can reliably keep your debt amounts from spiralling out of control.

#2: Refinance the loan

Works best when:

- You can wait a while before selling your car, or you can afford more expensive payments to quickly pay down the loan.

Pros:

- Can make a loan more bearable while you wait to get back above water.

Cons:

- This is not necessarily a direct method of reversing negative equity.

If you’ve paid responsibly on your car, you may be eligible to refinance the loan to get a better, more affordable rate.

Refinancing replaces your current loan with a new loan from a different lender, hopefully at more favorable terms. When refinancing, you can adjust the length of the loan, the interest rate, and the monthly payments. This could make it easier to maintain payments while you wait for the loan to get back above water.

#3: Work down the principal, without paying interest

Works best when:

- Your negative equity isn’t excessive.

- You can afford extra payments.

Pros:

- Has the potential to quickly reverse negative equity

Cons:

- Not every loan is eligible for principal-only payments. Some incur extra fees upon early payments, additional payments, or if you pay your loan off early.

Consider making additional, principal-only payments.

With most loans, your payments go toward paying off the interest first, then whatever’s left goes towards paying down the principal. This means that you may not be making as much progress on the loan as you think.

You can get around this by making principal-only payments. The way to do this depends on terms set by the lender upon initially granting the loan.

Normally, you can make principal-only payments by paying more than the minimum amount on your loan – but some lenders will charge a fee if you pay the loan off early. Some lenders don’t charge for paying the loan off early, but DO charge for paying more than your minimum payments. Others charge for making principal-only payments altogether.

Make sure to check with your lender to find out the best way to make principal-only payments.

#4: Keep your car for as long as possible before selling

Works best when:

- You don’t need a different car right away, and can afford your payments.

Pros:

- The negative equity will reverse on its own.

- You have time to research the market in your area and find prospective buyers for your car.

Cons:

- You risk accidents or damage to the car that would put it farther underwater.

The longer you keep your car, the more likely it is to get back above water. (As long as you can make your loan payments, of course.)

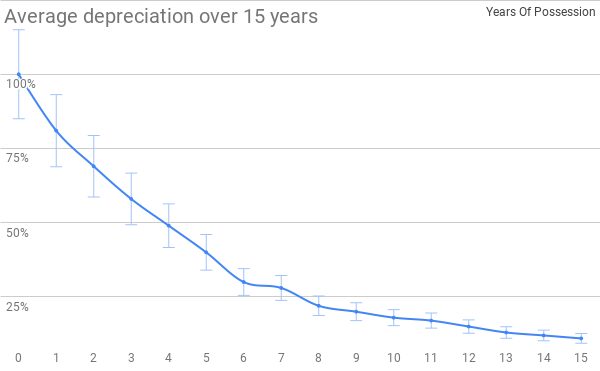

Cars don’t depreciate at the same rate over time.

New cars experience a sharp depreciation right after purchase, but used cars remain relatively steady in their depreciation over time. It’s likely that you’ll be able to catch up on the depreciation during the life of your loan.

This method only works if your car experiences normal wear and tear. Excess mileage, poor maintenance, or major damage can all increase the depreciation rate of your vehicle.

#5: Sell your car for as much as possible

Works best when:

- Your negative equity is within range of the vehicle’s FMV

- You’re comfortable handling the sale of your car

Pros:

- The quickest, most direct way to pay off negative equity

Cons:

- No guaranteed sale amount

Depending on how far underwater the loan is, the amount of money you have to pay back may actually be within range of a Fair Market Value.

Easy, cheap, or free fixes can be made to increase your car’s FMV.

Managing your car’s sale yourself allows you to make sure you get as much as possible from the sale. When you sell your car to a dealer, their only motivation is to turn a profit. This means that their goal is to acquire the car for as little as possible – not necessarily to help you get out of debt.

Finding private buyers is likely the best option. Posting on used car buying groups on Facebook, or on listing aggregators like CarGurus or Autotrader may help. (Just be wary – aggregators often charge a small fee for posting your listing, or when your car sells.)

When vetting buyers, be sure to be responsive and accommodating. Do everything you can to make the process as easy as possible on prospective buyers.

Still need help?

If you’re still not sure which option is the best for you, we may be able to help. Call us at (919) 880-2975 for free, no-obligation advice on your specific situation.

Negative Equity is not a hopeless situation. With a little planning and patience, you can escape an underwater loan.